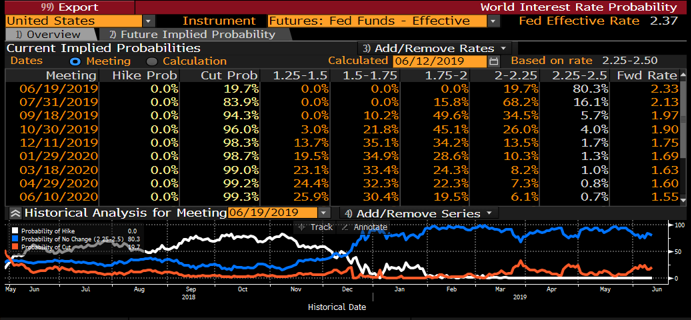

After the S&P 500 suffered one of its worst May’s in decades, stocks are rallying so far in June on expectations the Federal Reserve is about to cut interest rates. The next Federal Reserve Open Market Committee meeting is set for June 19, 2019. Based on the Bloomberg World Interest Rate Probability screen (WIRP), markets are pricing in a 20% chance for a rate cut next week, an 84% chance in..

Read Full ArticleWell it’s official, the lazy days of summer are over. The kids are back in school, Wall Street is back to work and Halloween decorations are already showing up in stores. Volatility in markets has returned, and our risk models are beginning to make adjustments to portfolios. September and October are notorious for some of the highest market volatility on record. Likewise, November and December..

Read Full ArticleLast week we shared how the Bloomberg World Interest Rate Probability Indicator reading reached the 100 percent level for a rate increase at the March 15th FOMC meeting. (See Beware The Ides of March) While we pay close attention to WIRP, it’s not the only data point pointing towards higher interest rates.

Read Full Article

15 Enterprise, Suite 450, Aliso Viejo, CA 92656

Call: +800.290.8633 | Fax: +949.382.1497

www.anchor-capital.com

Privacy Policy | Disclaimer | ADV Part II | Tax and Legal Advice Disclaimer

©2019 Anchor Capital Management Group, Inc. All Rights Reserved. Important disclosure information: This web site, and above links, contains information that has multiple authors and will offer multiple opinions on topics of interest. Any original written material on this web site, either authored by Anchor Capital staff, or external authors, are strictly the opinion of the author and not of Anchor Capital. If you find material that is inaccurate or defaming in any way, please contact us. No Solicitation or Investment Advice: The material contained on this website is for informational purposes only and Anchor Capital is not soliciting any action based upon such material. The material is not to be construed as an offer or a recommendation to buy or sell a security nor is it to be construed as investment advice. Additionally, the material accessible through this website does not constitute a representation that the investments described herein are suitable or appropriate for any person. Various links on this site will allow you to leave the Anchor Capital Web site. The linked sites are not under the control of Anchor Capital, and Anchor Capital is not responsible for the contents of any linked site or any link contained in a linked site, or any changes or updates to such sites. Anchor Capital is not responsible for any correspondence via email or any other medium, email list servers, webcasting or any other form of transmission received from any linked site. Links to external sources do not imply any official endorsement by Anchor Capital or the opinions, ideas or information contained therein, nor guarantees the validity, completeness or utility of the information provided. Anchor Capital shall not be held liable for improper or incorrect use of data or information contained in any electronic publications. Data, information, and related graphics contained in electronic publications are not legal documents and are not intended to be used as such. Anchor Capital gives no warranty, express or implied, as to the accuracy, reliability, utility or completeness of any information contained in any electronic document.